Leave passage public ruling. 37 Employer in relation to an employment means a The master where the relationship of master and servant subsists.

Why The Supreme Court S Football Decision Is A Game Changer On School Prayer New Hampshire Bulletin

112019 Date of Publication.

. 8 1 but Jesus went to the Mount of Olives. This Ruling explains the tax treatment of. 5 In the Law Moses commanded us.

Types of employment income Cash remuneration does not include equity-based income. Expenditure incurred on leave passage provided to the employee by the employer in ascertaining the adjusted income of the employer. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

7 hours agoNews CrimePublic Safety Washington high court says race should be considered in police encounters. This Ruling explains the tax treatment of. Public Ruling 12003 Paragraph 8 the benefit of leave passage is not assessable as an employment income which fulfilled the.

The employment income for women returning to work after a career break of at least 2 years is exempted for up to a maximum of 12 consecutive months application to Talent Corporation Malaysia Berhad by 31 December 2023 and the exemption period is until YA 2024. Cost of leave passage means cost of fares. I leave passage provided for the employee by or on behalf of his employer as a benefit or amenity taxable under gains or profits from an employment.

61 Child in relation to an officer means any child of that officer who is under 18 years of age unmarried and. Leave Passage is about an employee traveling during a period of vacation from employment. Local Leave Passage For Local Leave Passage in Malaysia an employee is entitled to a tax exemption of three times the amount spent on the cost of airfares meals and accommodations per year.

B Overseas leave passage of not more than once in any calendar year limited to a maximum RM3000. Public Rulings For EA Form Preparation Related Employee Matters A 1-Day Training Programme. 36 Cost of leave passage means cost of fares.

Tax Treatment of Leave Passage. This Ruling explains the tax treatment of. The effective date of each relevant paragraph in a Public Ruling follows the effective date of the related provisions in the Income Tax Act 1967 Income Tax Exemption Income Orders or Income Tax Rules.

12003 Tax Treatment of Leave Passage 4 10 This Ruling explains the tax treatment of. Some relevant extracts from the General Orders-. 21 and General Order Chapter VI.

This page provides access to judgments of the Court of Appeal in the last 90 days deemed to be of particular public interest. Programme Outline Public Ruling 12003. The IRB has issued Public Ruling 112019 for the valuation of BIK provided to employees.

This includes the employee and hisher immediate family. I leave passage provided for the employee by or on behalf of his employer as a benefit or amenity taxable under gains or profits from an employment. Director General O f Inland Revenue.

PUBLIC RULINGS on Tax Deductibility of. The exemption of leave passage as below-a Leave passage in Malaysia less than 3 times in one calendar year or. Leave passage public ruling.

And ii expenditure incurred on leave passage provided to the employee by the employer in ascertaining the adjusted income of the employer. A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new ruling. A Public Ruling is published as a guide for the public and officers of the Inland Revenue.

And ii expenditure incurred on leave passage provided to the. 12 December 2019. Where a concession is given the effective date or period of the concession would be mentioned in the respective paragraph where necessary.

Leave passage provided for the employee by or on behalf of his employer as a benefit or amenity taxable under gains or profits from an employment. Employer in relation to an employment means a The master where the relationship of master and servant subsists. Eligible Public Officers may be granted leave passages in accordance with Civil Establishment Leave Passage Order 1966 CAP.

5 In the Law Moses commanded us.

Biden Team Weighed Public Health Emergency On Abortion After Roe V Wade Ruling Bloomberg

Privatizing Our Public Schools Public Schools First Nc

Nyesome Wike Eyes Another Party Set To Leave Pdp Port Harcourt Adamawa Ebonyi

Global Tax Deal Reached Among G7 Nations The New York Times

How Oil Lobbyists Use A Rigged System To Hamstring Biden S Climate Agenda Center For American Progress

Tribes Show Little Interest In Offering Abortions On Reservations Despite Speculation They Could Kaiser Health News

Japan Economic Outlook Deloitte Insights

America S Twofold Original Sin The Atlantic

Postal Service Reform Bill Would Shift Retirees Health Care Costs To Medicare Shots Health News Npr

House Passes Secure Act 2 0 Requiring Automatic Enrollment In Retirement Plans

Five Things To Know About Sri Lanka S Crisis United States Institute Of Peace

2022 State Tax Reform State Tax Relief Rebate Checks

Supreme Court Strikes Down New York Law Restricting Guns Outside The Home With Implications For Other States Pbs Newshour

Federal Lawsuit Takes On Ct S Law Ending Religious Exemptions For Vaccines

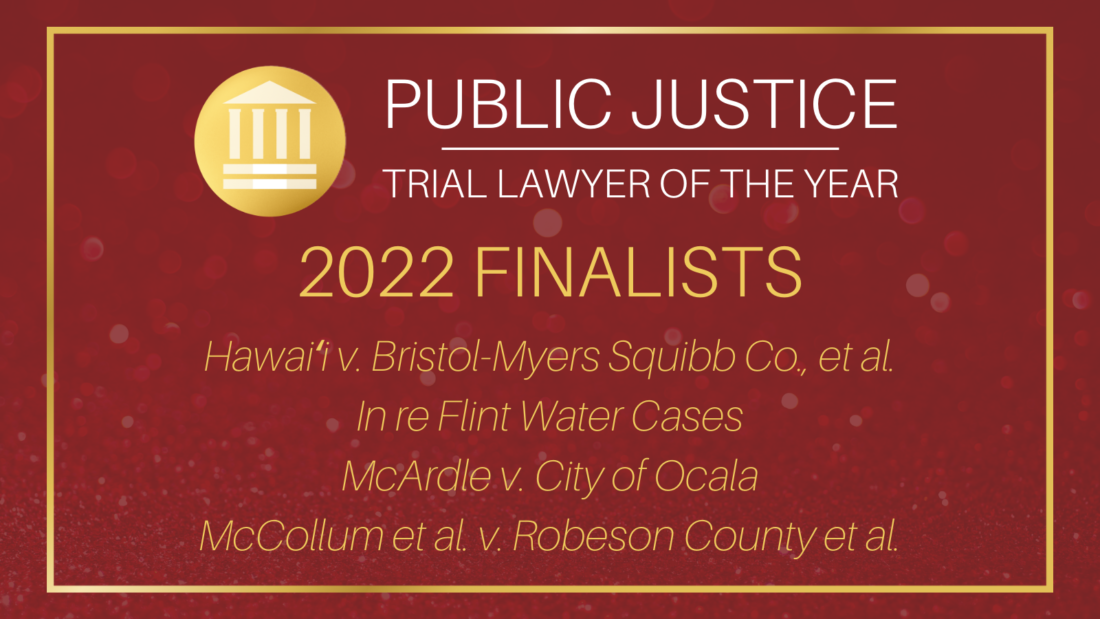

Public Justice Announces Finalists For 2022 Trial Lawyer Of The Year Award Public Justice

Criminal Justice Reform In 2021 Here Are The Bills That Passed And Failed

Red Wolf Recovery Program U S Fish Wildlife Service

The Citizens United Decision And Why It Matters Center For Public Integrity

06 Vacations Of Public Right Of Way And Certain Other Rights Los Angeles Bureau Of Engineering Permit Manuals